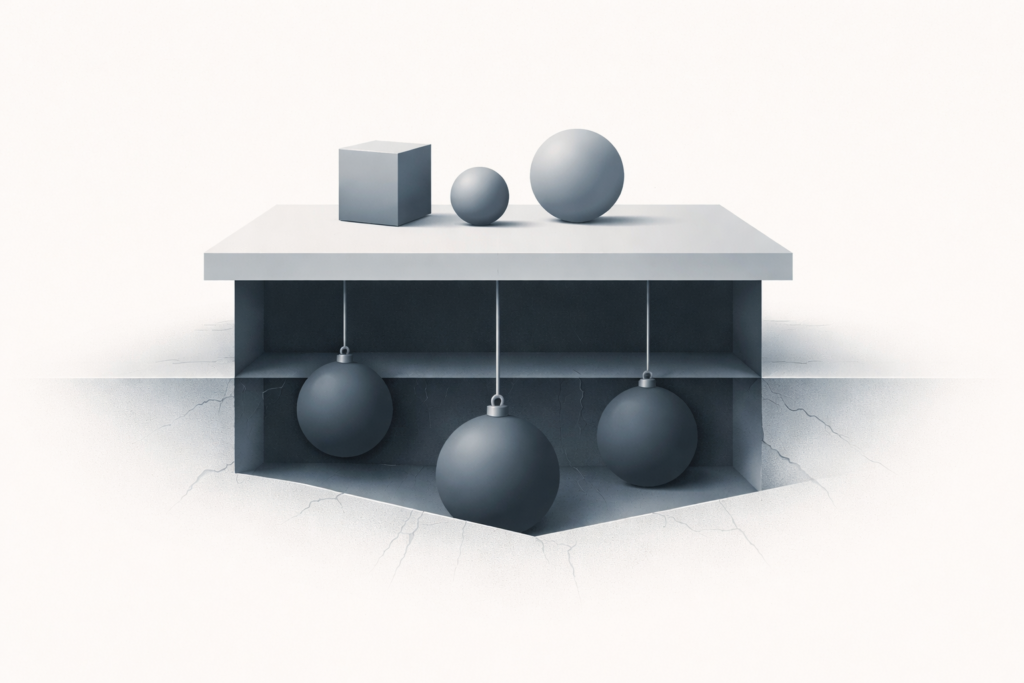

Leverage redistributes risk into less visible system layers.

Leverage Transfers Risk. This principle defines how leverage redistributes exposure without eliminating it.

Leverage Transfers Risk. This is the central clarification of Q4.9. Leverage is often described as a way to reduce risk by making outcomes more manageable, affordable, or efficient. Within FM Mastery, this description is treated as structurally inaccurate.

Leverage does not remove risk.

It repositions it.

This page exists to clarify a subtle but critical reality: leverage redistributes risk, frequently shifting exposure away from visible layers of a system and into places that are harder to observe, measure, or respond to. When this transfer goes unnoticed, systems become more fragile rather than more stable.

This distinction builds directly on the leverage discipline established in Leverage Eligibility vs Leverage Action and Why “Not Now” Is a Complete and Rational Leverage Decision.

Risk Is Never Removed, Only Relocated

This mechanism illustrates how leverage transfers risk rather than reducing it.

Risk is a function of uncertainty and consequence. Leverage does not change this function. What it changes is where uncertainty accumulates and how consequences surface.

Within Q4, risk is treated as persistent. Leverage modifies its expression, not its existence.

• What appears safer is often only less visible

• What feels lighter is often deferred

• What seems controlled is often redistributed

This redistribution is not inherently incorrect. It becomes dangerous only when it is misclassified as reduction. FM Mastery treats this misclassification as a governance failure, not a market error.

Visible Risk vs Latent Risk

Before leverage is applied, risk tends to be explicit. Exposure is often concentrated in observable places—cash outflow, commitment, or immediate consequence. These risks are uncomfortable but legible.

Leverage frequently converts visible risk into latent risk.

Latent risk does not announce itself. It accumulates beneath normal operation, embedded in structure rather than behavior. It may not affect outcomes immediately, allowing it to escape attention.

Within FM Mastery, latent risk is treated as more dangerous than visible risk precisely because it is easier to ignore. This framing is consistent with the constraint logic defined in Baseline Stability Before Leverage.

Structural Opacity as a Side Effect of Leverage

One of the least discussed effects of leverage is the opacity it introduces into systems.

As leverage redistributes risk:

• Causal links become harder to trace

• Responsibility becomes diffused

• Feedback arrives indirectly or late

The system continues to function, but with reduced clarity about why it functions and what it depends on. This opacity creates the illusion of stability by obscuring stress rather than resolving it.

Within Q4, opacity itself is treated as a form of risk.

Temporal Displacement of Consequences

Leverage often conceals risk by shifting it through time.

Immediate strain is reduced while future sensitivity increases. Consequences are displaced forward, away from the moment of decision. This temporal shift weakens feedback loops.

When feedback is delayed:

• Errors are harder to attribute

• Signals arrive after commitment is locked

• Correction becomes more costly

The system experiences calm now at the expense of volatility later. This trade is rarely explicit and therefore rarely evaluated.

Compressed Feedback Loops Increase Fragility

In systems without leverage, feedback is often direct. Changes produce responses that are quickly felt. This immediacy, while uncomfortable, supports learning and correction.

Leverage compresses feedback loops by absorbing initial impact. The system appears resilient only because early signals are dampened.

When feedback finally surfaces, it does so at higher intensity and with fewer options available.

FM Mastery treats this compression as a critical structural risk—not because failure is inevitable, but because awareness is reduced. This dynamic reinforces the separation defined in Leverage Eligibility vs Leverage Action.

Why Unnoticed Risk Is More Dangerous

Risk that is acknowledged can be governed.

Risk that is hidden cannot.

Unnoticed risk:

• Is not monitored

• Is not bounded

• Is not consciously accepted

It accumulates outside decision processes, surfacing only when tolerance is exceeded. At that point, the system reacts rather than interprets.

This is why Q4 prioritizes visibility over comfort. Reduced visibility does not indicate reduced exposure. It indicates that exposure has moved.

The Illusion of Safety Through Affordability

One of the most persistent misconceptions about leverage is that affordability equals safety. When immediate strain is lowered, the system feels more secure.

Within FM Mastery, this feeling is treated as unreliable.

Affordability alters distribution, not existence, of risk. When strain is smoothed in one layer, sensitivity increases in another.

Safety is not created.

It is displaced.

Decoupling Leverage From Perceived Security

Q4.9 exists to sever the assumed link between leverage and safety.

Leverage may make systems feel calmer, more controlled, or more manageable. These descriptions refer to perception, not structure.

Structure determines where risk resides.

Perception determines whether it is noticed.

FM Mastery prioritizes structure.

Closing Declaration

Leverage transfers risk.

It delays it.

It hides it.

When risk becomes less visible, it becomes harder to govern. When it becomes harder to govern, systems lose resilience without realizing it.

Within leverage discipline, the most dangerous risk is the one that no longer appears to exist.

Q4.9 exists to restore that visibility.

No action is required.

No correction is implied.

The distinction is complete.